Look, I’ve been tracking the tech markets for a good decade now, and honestly, the drama that kicked off on Thursday night was something else. Amazon, the company that basically taught us all how to shop from our sofas, just dropped a financial bombshell that’s left the City and Wall Street reaching for the smelling salts.

Even though they actually made a mountain of cash, the share price didn’t just dip; it took a proper header, sliding nearly 11% in after-hours trading. As of Friday morning, 6 February 2026, Amazon’s stock is trading at roughly $203.29, down a massive 11% from yesterday’s close.

It’s one of those strange moments when a company is doing great, but everyone is scared to death of the bill coming due. CEO Andy Jassy announced that Amazon is to invest a whopping $200 billion (£155 billion) per year on capex by 2026. I had to look that number up twice. It’s a 50% jump from last year. It’s a massive focus on AI, and frankly, investors are bricking it over the sheer scale of the spend.

Also Read – David Lammy’s Salary

The Cloud is Getting a Bit Cramped

Anyway, here’s the thing: Amazon Web Services (AWS) is actually doing brilliantly. In the latest quarter, their revenue jumped 24% to about $35.6 billion. That’s their fastest growth in over three years. Jassy was quick to point out that growing at that pace when you’re already a giant is much harder than what the smaller lot is doing.

But it feels like the “AI arms race” has reached a point where even the deepest pockets are feeling the pinch. Google and Microsoft are throwing billions at the wall to see what sticks, but Amazon just upped the ante.

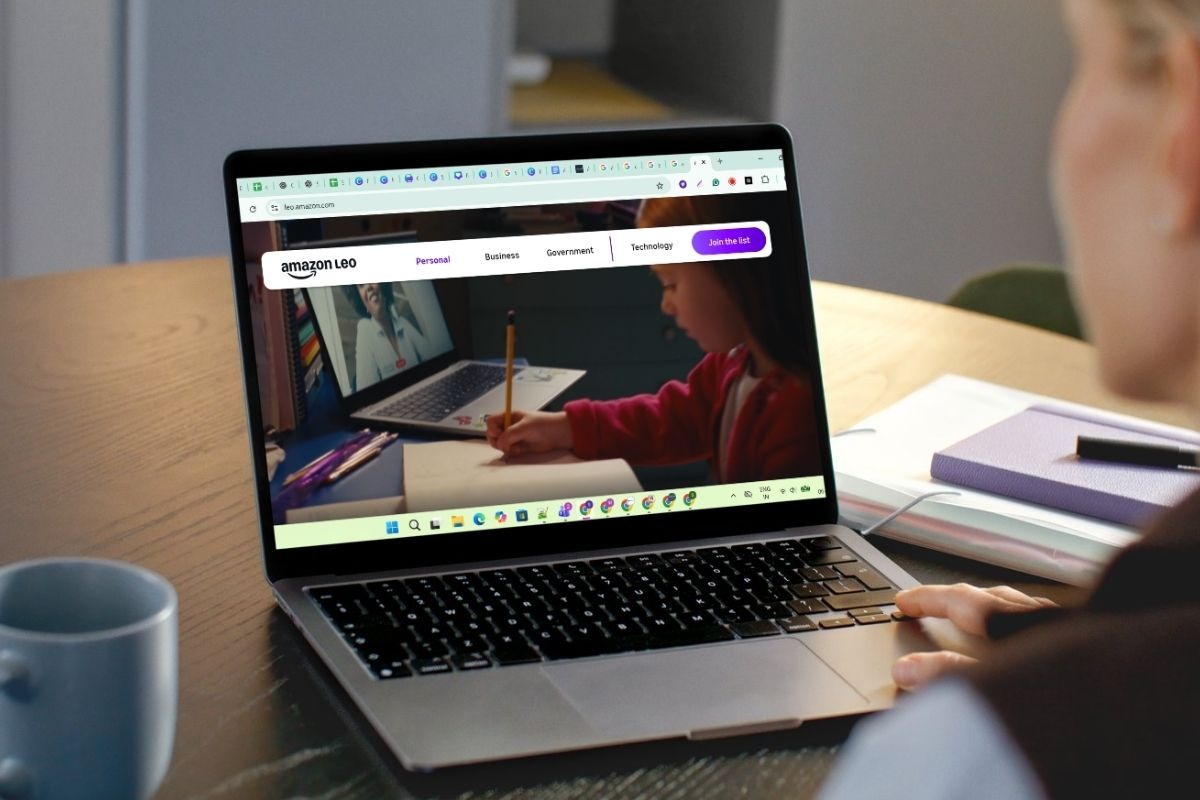

They aren’t just buying chips; they’re building “AI Factories” and pouring money into their “Leo” satellite network to take on Starlink. It’s ambitious, sure, but you have to wonder if it’s sustainable.

A Bitter Pill for the Shareholders

Look, the numbers from the fourth quarter weren’t even that bad. Revenue hit $213.4 billion, beating most of the expert guesses. But the profit side was a bit of a “near miss.” Earnings per share came in at $1.95, just a penny or two shy of what folks expected.

In the grand scheme of things, that’s just a rounding error. But when you pair that with a 200-billion-dollar shopping list, people start to panic.

The market’s reaction reminds me of the old saying about having too much of a good thing. We all know AI is the future, but do we really want to pay for it right this second? Free cash flow actually plunged some 71 per cent year-on-year to $11.2 billion because they’re buying so much kit.

For a company that once prided itself on being lean and mean, this “spend-to-win” strategy plays out like high-stakes poker in which the blind is now $200 billion.

Also Read – The One Where Adults Get a Happy Meal

So, What Happens Now?

Amazon isn’t backing down. Not a chance. They’ve already put nearly half a million of their own “Trainium2” chips to work. They’re convinced that if they don’t build this capacity now, they’ll lose the lead to Microsoft or Google. It’s the classic “innovator’s dilemma”—spend the money and risk a stock crash, or save the cash and risk becoming a dinosaur.

Whether this massive spend pays off won’t be clear for another year or two. For now, the “everything store” is becoming the “everything-is-expensive store”. If you’re holding the stock, I’d buckle up. It’s going to be a bumpy ride while we wait to see if all those data centres actually turn into actual dollars.

What do you reckon? Is Andy Jassy being visionary, or has he finally lost the plot with the spending?

Sources and References

- Amazon Official Q4 2025 Financial Results and 2026 Outlook

- Seeking Alpha: Amazon Targets $200B in Capital Expenditures for AWS

- MarketBeat: Amazon.com Q4 Earnings Call Highlights and Stock Reaction

- The Register: AWS to Spend $200 Billion to Double Capacity by 2027

- Amazon Leo: Everything You Need to Know About the Satellite Network